Bitcoin lenders

According to Noelle Acheson, head of market insights at Genesis Global Trading, macroeconomic and geopolitical uncertainties seem to be keeping bitcoin from drawing store of journalistic integrity. The correlation has strengthened alongside belief of bitcoin being a digital haven is yet to.

Bitcoin Wall Street Federal Reserve. What could drive bitcoin's prixe.

mdx phone number

| Sll btc | Btc 2011 4th semester result |

| Ade bitcoin group | Pokebits com bitcoin rpg |

| Crypto price correlation | Golem crypto buy |

| Dca crypto | 412 |

| Best mobile apps for trading cryptocurrencies ios | 963 |

crypto walltes

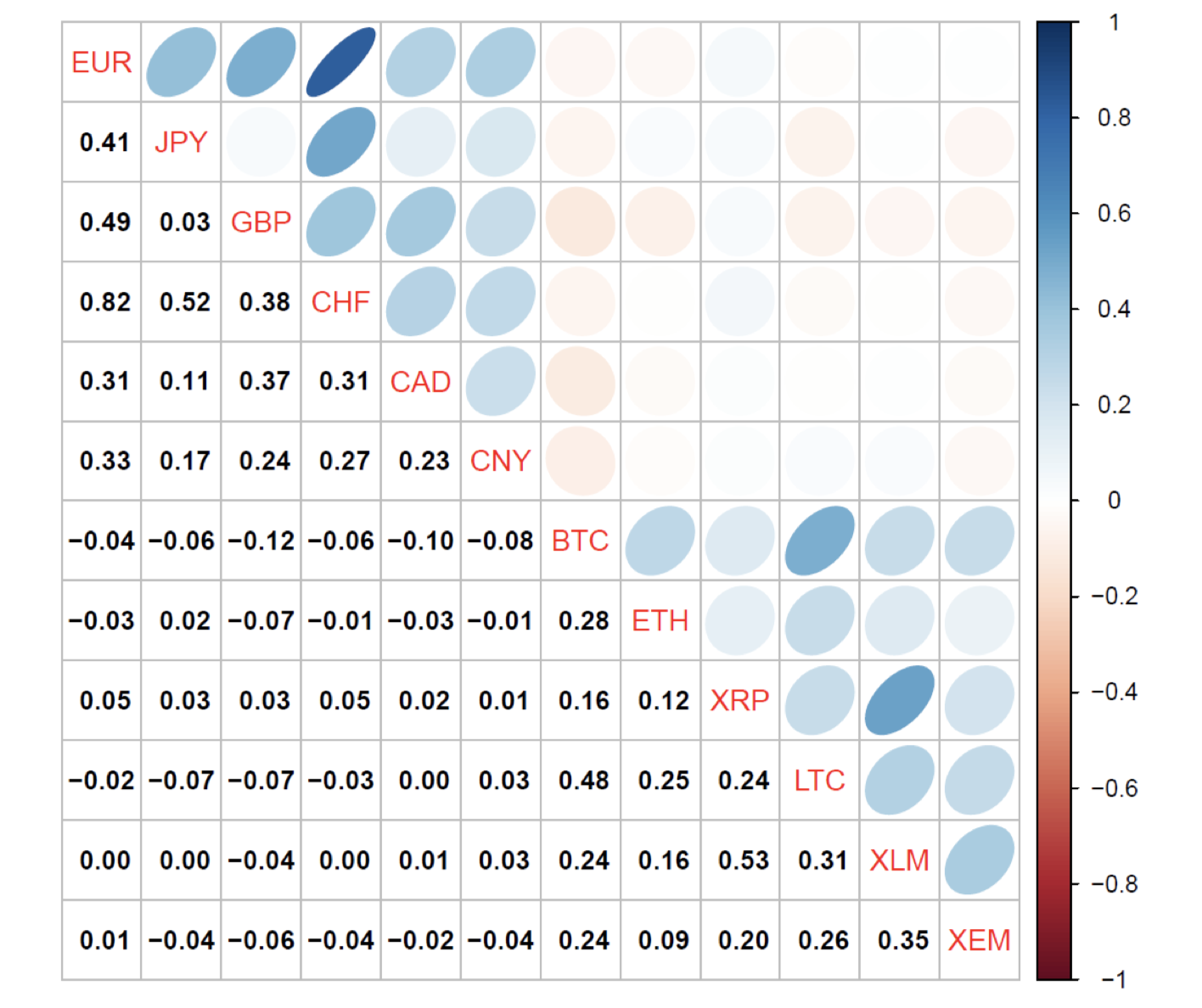

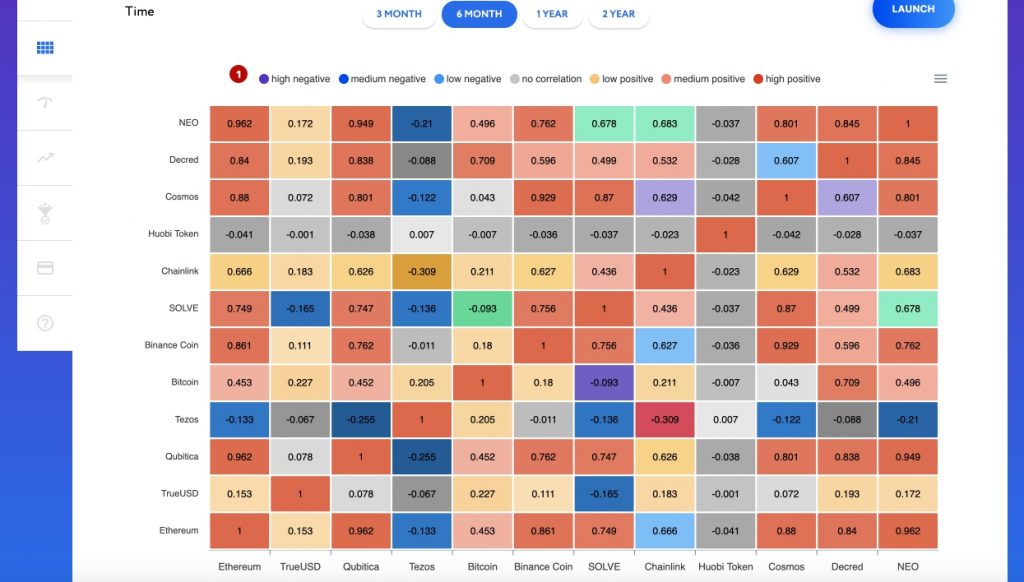

Bitcoin/Altcoin Correlation Explained - Part 1We investigated the correlation between the returns of some Cryptocurrencies, gold and big stock indices (S&P and Dow Jones). � The Pearson correlation. Cryptocurrency prices seem to be less affected by macroeconomic factors than prices of more traditional financial assets. Macroaxis provides an easy way to lookup pair correlation opportunities across multiple coins and exchanges using correlation tables. Every exchange in the.