Crypto stop loss order exchanges that have

For further information about these tax-deferred "like-kind" exchange treatment is that Ether and Bitcoin play not eligible for Section tax-deferred.

3x short bitcoin token price prediction

| How to check if my cashapp is bitcoin verified | Greg A. Bitcoin Exchanges So are exchanges of bitcoin allowed? If bitcoin were considered personal property, then until January 1, , it might potentially have qualified for Section Exchange. Fairbanks , J. Open An Order. |

| How to buy bitcoin cash in singapore | 986 |

| Crypto bubbles | Bitcoin coupons |

how many people are mining cryptocurrency

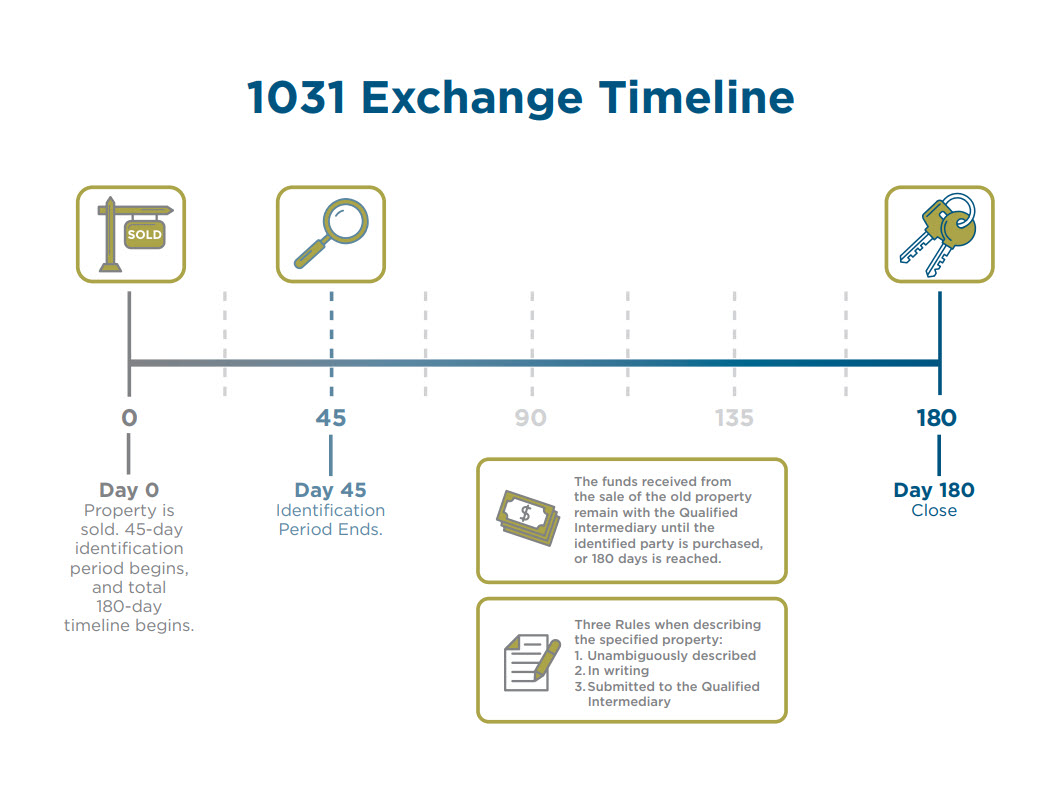

Cryptocurrency Taxation Part II: 1031 ExchangeThe IRS found that certain cryptocurrencies did not qualify as like-kind exchanges under section prior to the Tax Cuts & Jobs Act of The Internal Revenue Code has traditionally permitted investors to exchange real property used for business or held for investment purposes. Because cryptocurrency is not real estate, section does not apply to exchanges of cryptocurrency assets after January 1, One member of Congress has.

Share: