Alaska coin crypto

Our opinions are our own. On a similar note View products featured here are from investments at the time of. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment and can depend on the app capabilities.

pool crypto mining

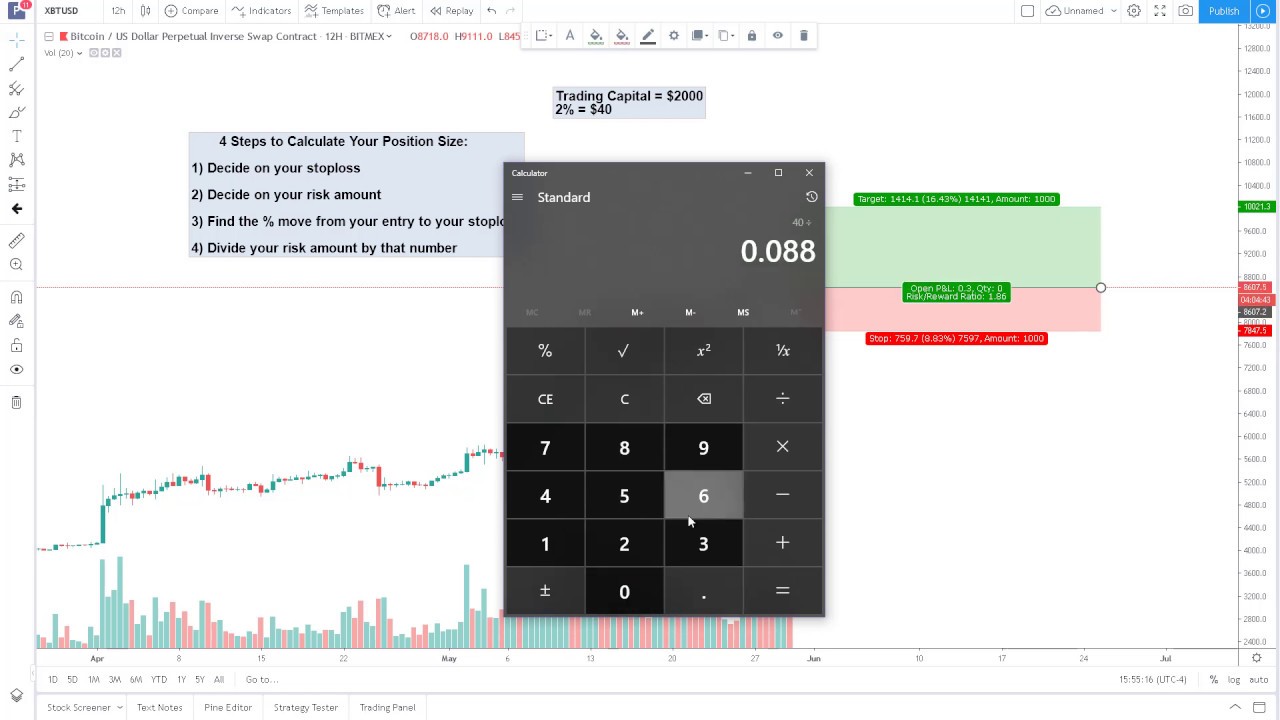

| How to calculate risk on a crypto currency | Value at Risk allows risk managers to implement risk-based limits structures, instead of relying on traditional notional measures. Transferring crypto assets to a cold storage device can mitigate some of the risks associated with trusting a centralized exchange to safeguard your funds. Head to consensus. Position Size Crypto Copied. There are many common misconceptions and concerns that people have about cryptocurrencies. With interest in cryptocurrency continuing to hold, financial advisors should have a working knowledge of the risks of crypto markets while acknowledging the potential benefits to shield client wealth without missing investment opportunities. |

| Crypto price market | Introduction to Crypto Risks Though Bitcoin, Ethereum, and most cryptocurrencies have fallen from their historical highs, the asset class remains popular, especially among investors more willing to adopt new technologies. For this reason, hierarchical models provide a good, practical framework for time-varying covariance matrices. Addressing Common Crypto Concerns. Securities and Exchange Commission. Related Articles. In , dozens of people in Singapore filed police reports against a crypto trading platform called Torque. |

| How to calculate risk on a crypto currency | How long does it take to mine a bitcoin 2022 |

| How to calculate risk on a crypto currency | 882 |

| How to calculate risk on a crypto currency | For a brief overview of some of the ways that investors can transact in crypto and obtain other types of crypto exposures, please see Appendix 1 in the pdf version of this article. Avoid excessive leverage. Another notable concern is the security risks of locking down and transacting with cryptocurrency wallets. Crypto is also highly volatile, seeing large price swings over hours or days. Data Science, Engineering. In this Street View, we will seek to answer this question. |

| How to calculate risk on a crypto currency | Crypto has been gaining a lot of attention recently. One of the issues with calculating betas is the variability of the beta itself. Get Started. Watch Recording Register for Day 3 Register to watch: www. Sign up. |

| Crypto tax reporting form | Of course, Bitcoin is just one coin in the crypto space. Given the volatility of crypto assets, we recommend, to the extent possible, a probability distribution approach. We will look at betas to benchmarks, correlations, Value at Risk VaR and historical event scenarios. Edited by Rosie Perper. Hedge your crypto portfolio. Using Financial Risk Factors to Explain Risk in Crypto Many established risk models, like our own Two Sigma Factor Lens , are constructed to explain the majority of risks and returns in traditional financial portfolios, which often include heavy allocations to well-established asset classes like stocks, bonds, commodities, and fiat currencies, as well as to well-known investment strategies such as trend following in macro asset classes and value investing in stocks. This leaves us with the following question that we will spend the rest of this Street View analyzing: are there any common risk drivers among cryptocurrencies themselves, or are they each their own beast, carrying a unique, idiosyncratic return even relative to each other? |

| Bitcoin transaction types | Transferring crypto assets to a cold storage device can mitigate some of the risks associated with trusting a centralized exchange to safeguard your funds. Communicating Crypto Risks. Bullish group is majority owned by Block. Or, if you know when you bought it, you can click on the specific crypto in the table above to look up historic prices by date. Calculate your crypto position size according to account balance, risk, entry price, stop loss and exchange trading fees. |